Accounting Today Names BPW a ‘2022 Best Midsized Firm to Work For’ 10 Years Running

SANTA BARBARA, CA – September 15, 2022 – Bartlett, Pringle, & Wolf, LLP (BPW) was recently…

Crystal A. Knepler Named Partner

SANTA BARBARA, CA – September 1, 2022 – Bartlett, Pringle & Wolf, LLP (BPW), a leading…

A Fresh Look at Retirement Withdrawal Rules

Strict rules govern the timing of retirement account withdrawals. These rules may change in the near…

BPW Named Among Accounting Today’s 2022 Top Regional Leaders

Bartlett, Pringle & Wolf, LLP (BPW) is excited to share that the firm was recently named…

Is Now the Right Time to Invest in Cryptocurrency?

Cryptocurrency has been in the news a lot lately as it continues to gain traction as…

Your Year-End 401(k) Compliance Roadmap: A Strategic Planning Guide

Your Year-End 401(k) Compliance Roadmap: A Strategic Planning Guide Authored by Tracey Solomon As we approach ...

Read this insight Why 2025 Year-End Tax Planning Matters More Than Ever

As 2025 draws to a close, businesses and individuals face a tax planning environment unlike any ...

Read this insight 40 Under 40 Honoree: How Michael Shaner is Shaping the Future of Business

In the competitive world of accounting and advisory services, it takes more than technical expertise to ...

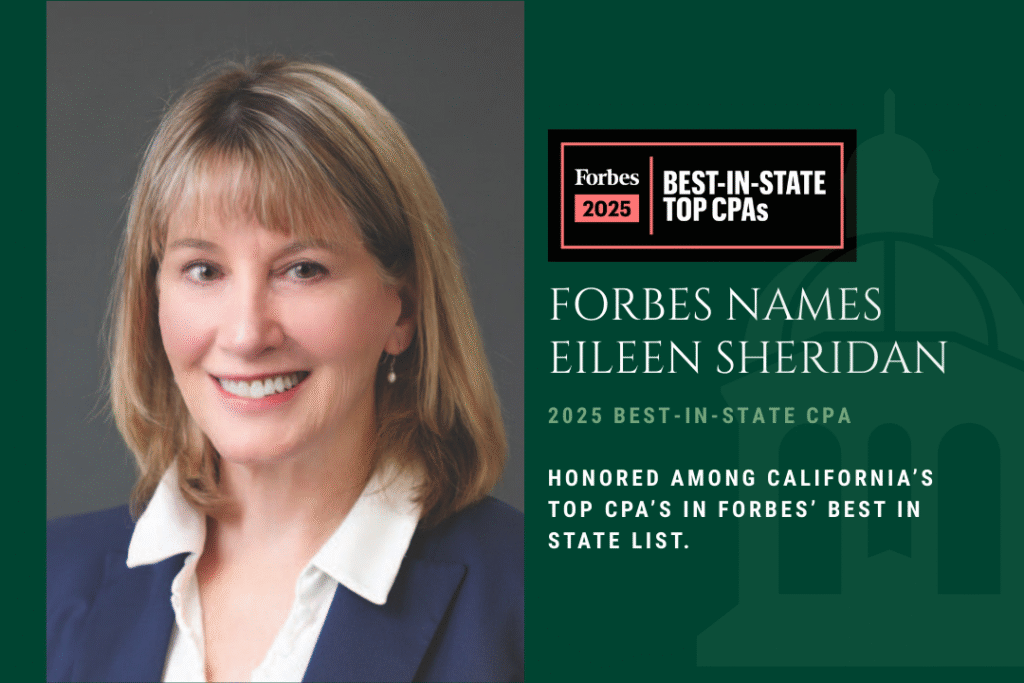

Read this insight Forbes Names Eileen Sheridan 2025 Best in State CPAs

Sheridan honored among top CPAs in California in Forbes’ inaugural Best-In-State list As a leading accounting ...

Read this insight Strategic Tax Planning: How the OBBBA Influences Future Business Decisions

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, ushers in ...

Read this insight Bartlett, Pringle & Wolf, LLP Named One of California’s Best Workplaces for 2025 by Best Companies Group

Santa Barbara, CA- Best Companies Group recently recognized Bartlett, Pringle & Wolf, LLP (BPW) as one of ...

Read this insight Update on the Corporate Transparency Act: Court Suspends Reporting Requirements for Businesses

Less than one month before the Corporate Transparency Act’s (CTA) Beneficial Ownership Information (BOI) reporting deadline, ...

Read this insight Year-End Tax Planning for Individuals

As we approach 2025, future tax policy is bracing for change in the coming years. With ...

Read this insight Year-End Tax Planning for Businesses

After a few years of relatively mild tax changes for most businesses, post-election results provide more ...

Read this insight Britton and Schmoller Recognized as Top Professional Service Leaders on Central Coast

Bartlett, Pringle & Wolf, LLP is pleased to announce that John Britton, CPA and Rosemary Schmoller, ...

Read this insight Eileen Sheridan Named a 2024 Managing Partner Elite by Accounting Today

SANTA BARBARA, CA – Accounting Today magazine recently named Eileen Sheridan, CPA a 2024 MP Elite, ...

Read this insight INSIDE Public Accounting Ranks BPW Among Top 300 Firms in US

SANTA BARBARA, CA – INSIDE Public Accounting (IPA) recently ranked Bartlett, Pringle & Wolf, LLP No. 300 ...

Read this insight