5 New Updates on Economic Impact Payments

New information continues to unfold as Congress provides clarity on several aspects of the economic impact…

The CARES Act: Big Changes to Retirement Plans

Let’s talk retirement planning. How should retirement accounts be handled after the big changes seen in…

The SECURE Act: Key Takeaways and Strategies to Consider

Over the past few years, we have seen some of the greatest shifts in tax legislation.…

IRS Establishes No Clawback Rule on Gifts and Estates

‘Tis the season for giving! In a recent announcement, the IRS presented the highly-anticipated final regulations…

How to Leave Your Digital Legacy

As we continue to expand our digital footprint, it is important to incorporate our digital lives…

Advantages of a Cost Segregation Study

Whether putting up a new building or renovating an existing one, companies are discovering that they ...

Read this insight Pass-Through Entity Updates Webinar

We have been closely following the new filing requirements being issued from the IRS, as well ...

Read this insight Tax Alert Webinar: Find Out What the New IRS Guidance and CA Tax Law Changes Mean for Your Business

Thursday, March 3 1:00pmLive Webinar SIGN UP NOW Are you curious about…how California's recently ...

Read this insight Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S ...

Read this insight What You Need to Know About the Child Tax Credit and Economic Impact Payment Notices

Many taxpayers have already received IRS Letters 6419 and 6475 containing details about their 2021 advance ...

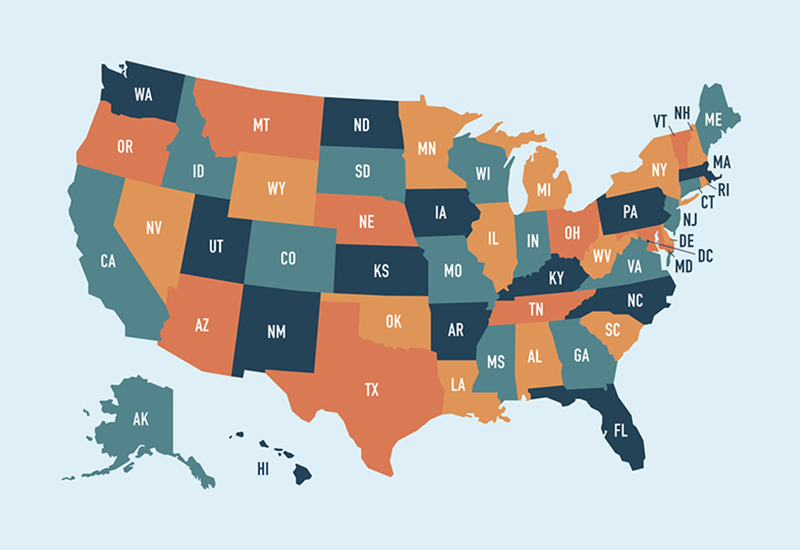

Read this insight Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work ...

Read this insight How are Trusts Taxed?

three generation happy asian family walking outdoors in park A trust can be a powerful estate-planning ...

Read this insight Tax Breaks for the Elderly

Getting older has its perks, including tax breaks. Your income threshold for filing a tax return ...

Read this insight IRS Announces 2022 Limits for Retirement Plans

The IRS has announced the new retirement plan numbers for 2022.Retirement limits for 401(k) and similar ...

Read this insight What Papers do You Need to Save?

Sometimes it feels good to get rid of clutter, especially this time of year when the ...

Read this insight DOL Reveals Key Change for Tipped Workers

Employees in occupations where gratuities are common, such as restaurant waitstaff, have long fallen into a ...

Read this insight Section 174 Research Deduction Changes for 2022

Have you been deducting your R&D expenses as they occur? Starting in the new year, that ...

Read this insight