5 New Updates on Economic Impact Payments

New information continues to unfold as Congress provides clarity on several aspects of the economic impact…

The CARES Act: Big Changes to Retirement Plans

Let’s talk retirement planning. How should retirement accounts be handled after the big changes seen in…

The SECURE Act: Key Takeaways and Strategies to Consider

Over the past few years, we have seen some of the greatest shifts in tax legislation.…

IRS Establishes No Clawback Rule on Gifts and Estates

‘Tis the season for giving! In a recent announcement, the IRS presented the highly-anticipated final regulations…

How to Leave Your Digital Legacy

As we continue to expand our digital footprint, it is important to incorporate our digital lives…

Your Year-End 401(k) Compliance Roadmap: A Strategic Planning Guide

Your Year-End 401(k) Compliance Roadmap: A Strategic Planning Guide Authored by Tracey Solomon As we approach ...

Read this insight Why 2025 Year-End Tax Planning Matters More Than Ever

As 2025 draws to a close, businesses and individuals face a tax planning environment unlike any ...

Read this insight 40 Under 40 Honoree: How Michael Shaner is Shaping the Future of Business

In the competitive world of accounting and advisory services, it takes more than technical expertise to ...

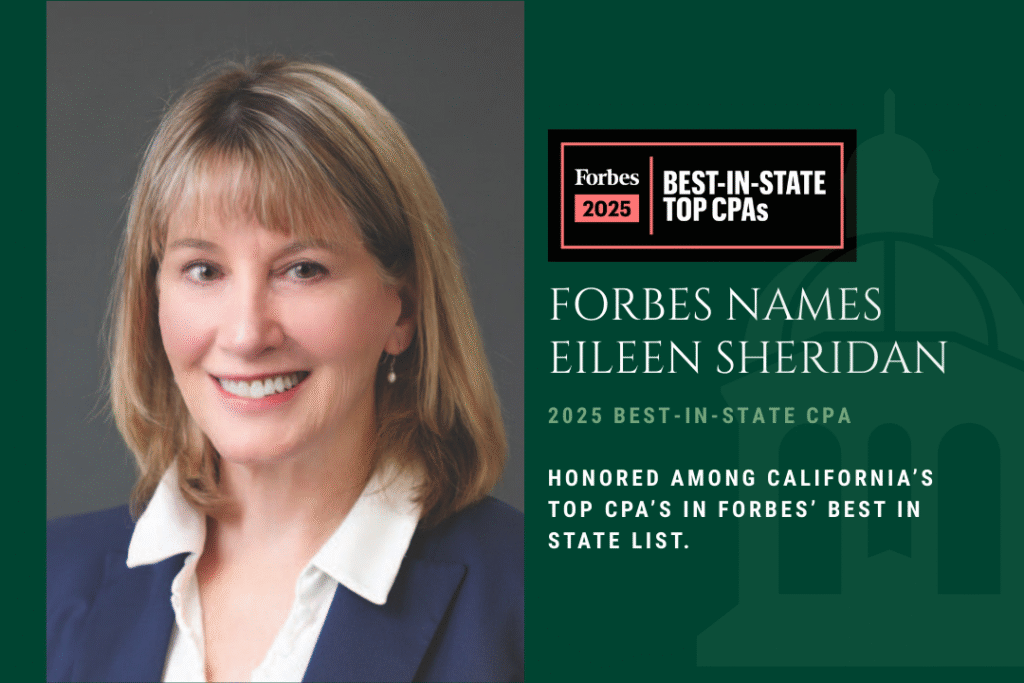

Read this insight Forbes Names Eileen Sheridan 2025 Best in State CPAs

Sheridan honored among top CPAs in California in Forbes’ inaugural Best-In-State list As a leading accounting ...

Read this insight Strategic Tax Planning: How the OBBBA Influences Future Business Decisions

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, ushers in ...

Read this insight Bartlett, Pringle & Wolf, LLP Named One of California’s Best Workplaces for 2025 by Best Companies Group

Santa Barbara, CA- Best Companies Group recently recognized Bartlett, Pringle & Wolf, LLP (BPW) as one of ...

Read this insight Update on the Corporate Transparency Act: Court Suspends Reporting Requirements for Businesses

Less than one month before the Corporate Transparency Act’s (CTA) Beneficial Ownership Information (BOI) reporting deadline, ...

Read this insight Year-End Tax Planning for Individuals

As we approach 2025, future tax policy is bracing for change in the coming years. With ...

Read this insight Year-End Tax Planning for Businesses

After a few years of relatively mild tax changes for most businesses, post-election results provide more ...

Read this insight Britton and Schmoller Recognized as Top Professional Service Leaders on Central Coast

Bartlett, Pringle & Wolf, LLP is pleased to announce that John Britton, CPA and Rosemary Schmoller, ...

Read this insight Eileen Sheridan Named a 2024 Managing Partner Elite by Accounting Today

SANTA BARBARA, CA – Accounting Today magazine recently named Eileen Sheridan, CPA a 2024 MP Elite, ...

Read this insight INSIDE Public Accounting Ranks BPW Among Top 300 Firms in US

SANTA BARBARA, CA – INSIDE Public Accounting (IPA) recently ranked Bartlett, Pringle & Wolf, LLP No. 300 ...

Read this insight