The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

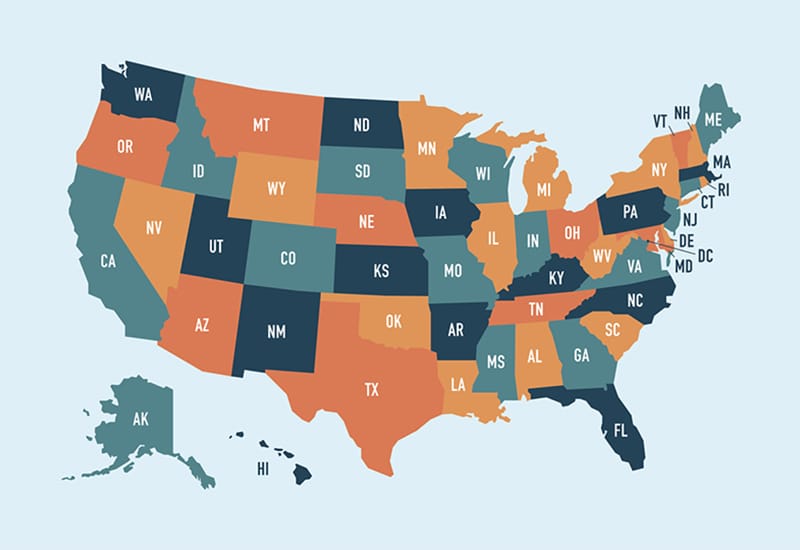

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...Erroneous Notices from the IRS and States

Many clients have received CP59 Notices notifying them about missing Forms 1040 for the tax year 2019. In…

Read this Insight...Year-End Tax Planning for Businesses

Many businesses remain steeped in financial, operational, and HR challenges related to the COVID-19 crisis, but…

Read this Insight...