Proposition 55 Approved by Voters

Share post:

Voters in California recently elected to extend increased personal income taxes on higher-earning taxpayers. With 62% in favor of the measure, California continues to lead as the highest income tax state, with a top rate of 13.3%.

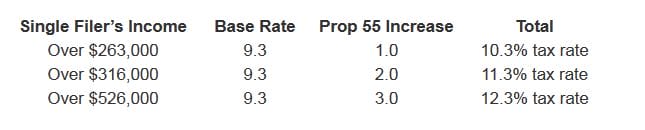

Proposition 55 has extended temporary tax hikes through 2030, which were previously set to expire in 2018. This extension means the following rate increases for single-filer taxpayers currently in place for years 2012 through 2018 will continue through 2030 (double the figures for joint-filers):

Keep in mind that these are not the only “add-on taxes” for California taxpayers. Earners with income in excess of $1,000,000 will face an additional 1% Mental Health Services Tax Rate, to reach the top 13.3% rate.

Proposition 55 is an extension of Proposition 30, which was approved in November 2012 and made retroactive to January 1 of that year. The additional tax affects roughly 1.5% of taxpayers with the highest income who fall into the top three tax brackets.

According to the California Secretary of State, the state plans to distribute the measure’s tax revenue to support K-12 schools, California community colleges, and other healthcare programs. The state anticipates an increase of revenue between $4 billion to $9 billion annually from 2019 to 2030, depending on market conditions.

BPW is actively engaged in year-end tax planning and is happy to help you develop a strategy to minimize your tax burden. Please contact your advisor at (805) 963-7811 to get started.