Expanded Sec. 152 for Dependents

The Tax Cuts and Jobs Act broadened the Child Tax Credit and introduced some big changes…

The Impact of Tax Reform on Alimony

The Tax Cuts and Jobs Act has turned the tax code upside down on alimony, especially…

IRS Releases 2018 Pension Plan Contribution Limits

A new year brings new changes. The Internal Revenue Service recently announced updated pension plan contribution…

A New Twist on an Old Scam

As many are aware, tax scams are on the uptick. What you may not know is…

Construction Companies Go Green

The construction industry has discovered that greening its energy sources with renewable energy initiatives is good…

New Deadline and Increased Penalties for Forms 1099 and W-2

The IRS is getting stricter on filing deadlines for information returns and have increased penalties for…

IRS Announces Various Tax Benefit Increases for 2016

For tax year 2016, the IRS recently announced many annual inflation adjustments. IRS Revenue Procedure 2015-53…

Your Year-End 401(k) Compliance Roadmap: A Strategic Planning Guide

Your Year-End 401(k) Compliance Roadmap: A Strategic Planning Guide Authored by Tracey Solomon As we approach ...

Read this insight Why 2025 Year-End Tax Planning Matters More Than Ever

As 2025 draws to a close, businesses and individuals face a tax planning environment unlike any ...

Read this insight 40 Under 40 Honoree: How Michael Shaner is Shaping the Future of Business

In the competitive world of accounting and advisory services, it takes more than technical expertise to ...

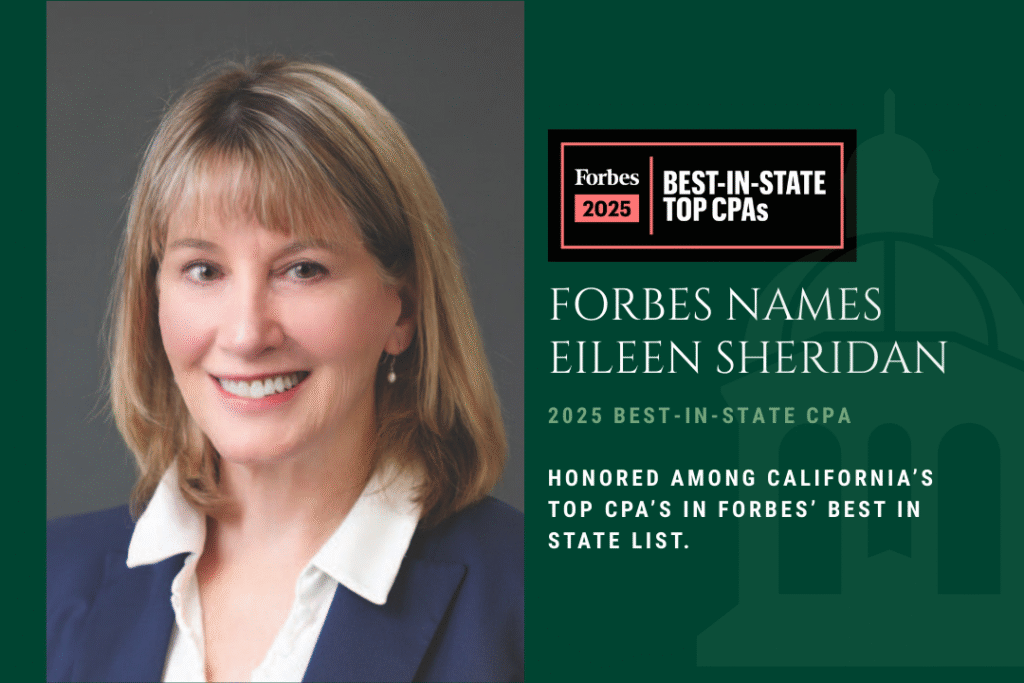

Read this insight Forbes Names Eileen Sheridan 2025 Best in State CPAs

Sheridan honored among top CPAs in California in Forbes’ inaugural Best-In-State list As a leading accounting ...

Read this insight Strategic Tax Planning: How the OBBBA Influences Future Business Decisions

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, ushers in ...

Read this insight Bartlett, Pringle & Wolf, LLP Named One of California’s Best Workplaces for 2025 by Best Companies Group

Santa Barbara, CA- Best Companies Group recently recognized Bartlett, Pringle & Wolf, LLP (BPW) as one of ...

Read this insight Update on the Corporate Transparency Act: Court Suspends Reporting Requirements for Businesses

Less than one month before the Corporate Transparency Act’s (CTA) Beneficial Ownership Information (BOI) reporting deadline, ...

Read this insight Year-End Tax Planning for Individuals

As we approach 2025, future tax policy is bracing for change in the coming years. With ...

Read this insight Year-End Tax Planning for Businesses

After a few years of relatively mild tax changes for most businesses, post-election results provide more ...

Read this insight Britton and Schmoller Recognized as Top Professional Service Leaders on Central Coast

Bartlett, Pringle & Wolf, LLP is pleased to announce that John Britton, CPA and Rosemary Schmoller, ...

Read this insight Eileen Sheridan Named a 2024 Managing Partner Elite by Accounting Today

SANTA BARBARA, CA – Accounting Today magazine recently named Eileen Sheridan, CPA a 2024 MP Elite, ...

Read this insight INSIDE Public Accounting Ranks BPW Among Top 300 Firms in US

SANTA BARBARA, CA – INSIDE Public Accounting (IPA) recently ranked Bartlett, Pringle & Wolf, LLP No. 300 ...

Read this insight